Currently, the cryptocurrency market is in a bull run that has never been witnessed before. Many cryptocurrencies, Bitcoin being at the forefront of everything, are rewriting their all-time highs, thanks to favorable government regulations and the approval of Bitcoin ETFs (Exchange Trade Funds). At this time where Bitcoin is expected to hit $100K, what does it mean for Litecoin investors? When does the next Litecoin bull run begin? Let’s find out.

Litecoin: Current Market Cycle Phase

Investors believe that the cryptocurrency markets also follow the four-phased market cycle as with other traditional financial markets. The market cycle includes accumulation, mark-up, distribution, and mark-down. The mark-down phase marks the end of a cycle and the next phase begins with the accumulation phase.

In the accumulation phase, the price of the asset, Litecoin in this case tends to be low and more stable. During this period, savvy investors start accumulating holdings, in hopes of a future price surge. The market tends to be more fearful than greedy, and the public interest tends to be a lot less.

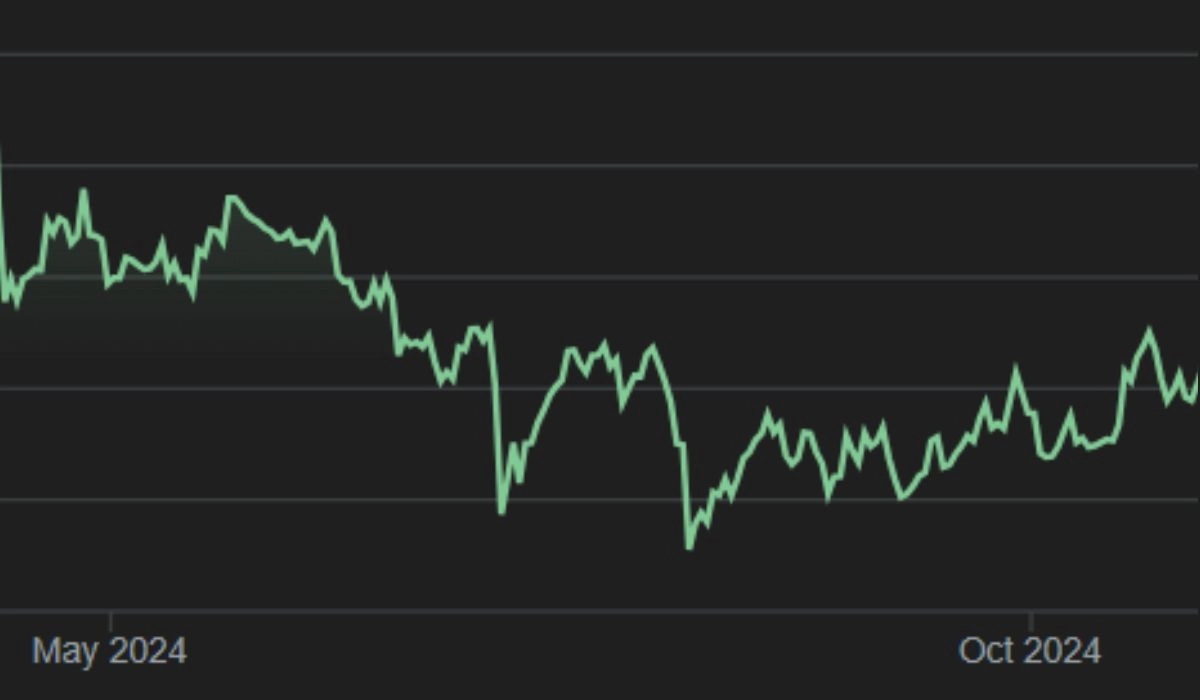

According to the market indicators, Litecoin has been in the accumulation phase for a couple of years. Keep in mind that the market cycle is used to represent a long period of the market rather than small price movements. The value of Litecoin has been stabilized in between $50, and $100. However, this is slowly changing.

Litecoin Accumulation Period is Ending

The Litecoin market is showing the characteristics of an ending accumulation phase. There has been a 29.43% price surge in the last month, and from 14000 votes, the community sentiments are 84% bullish as opposed to the 16% bearish sentiments.

The market has been experiencing relatively low price fluctuations, and the new technological updations in the Litecoin network, that raised the hash rate to an all-time high can contribute to better investor investment in the token and potentially improve the market significantly.

Litecoin Bull Run

The historical price of Litecoin also indicates that we are nearing the end of the Accumulation phase paving the way to the bull run. Litecoin hit its first all-time high of about $300 in the year 2017, and the next all-time high came about four years later, in 2021. So, if history repeats itself, the next high point of Litecoin can come in 2025. So, the market is anticipating a Litecoin bull run within a couple of months.

The current momentum of the cryptocurrency market may also help the bull run of Litecoin in the coming years. As more people join the cryptocurrency market, more markets poems up, and the need for Bitcoin alternatives can potentially increase. If the developers and community behind Litecoin keep on improving its service, security, and transaction speed, 2025 and the coming years look really bright for the coin.

Is this a Good Time to Invest in Litecoin?

According to certain indicators, the Price rally of LTC is still in its infancy. So, Litecoin can be a good long-term investment option. But it is better to invest in Litecoin when the price falls short term so that you can capitalize on price surges.

That being said, the market is already in its bull run and you have kind of missed your chance of getting aboard in the accumulation phase when the price was relatively lower. Still, investing in Litecoin can be beneficial long term.

What is the Best Entry and Exit Points for Litecoin?

Calculating the best entry and exit points in the Litecoin market needs extensive research and impeccable calculations. According to some cryptocurrency influencers including Alan Santana, Litecoin has the potential to hit a new all-time high in 2025. The coin is currently in its early bullish stages. So, it is best to invest in Litecoin if the price is below $100. You may want to HODL your investment for at least the beginning of the year 2025 and see whether the market is favorable. If the bull run continues its current momentum, you can have significant gains from your investment.

Final Thoughts: DYOR

All the data provided in this article is collected from public information. This article is just an observation which should not be considered as a financial advice. Cryptocurrency investments involve a considerable degree of risk. So, do your own research about the right time to enter and exit a market. Also, make sure that you have contingency plans in place to recover from potential losses.